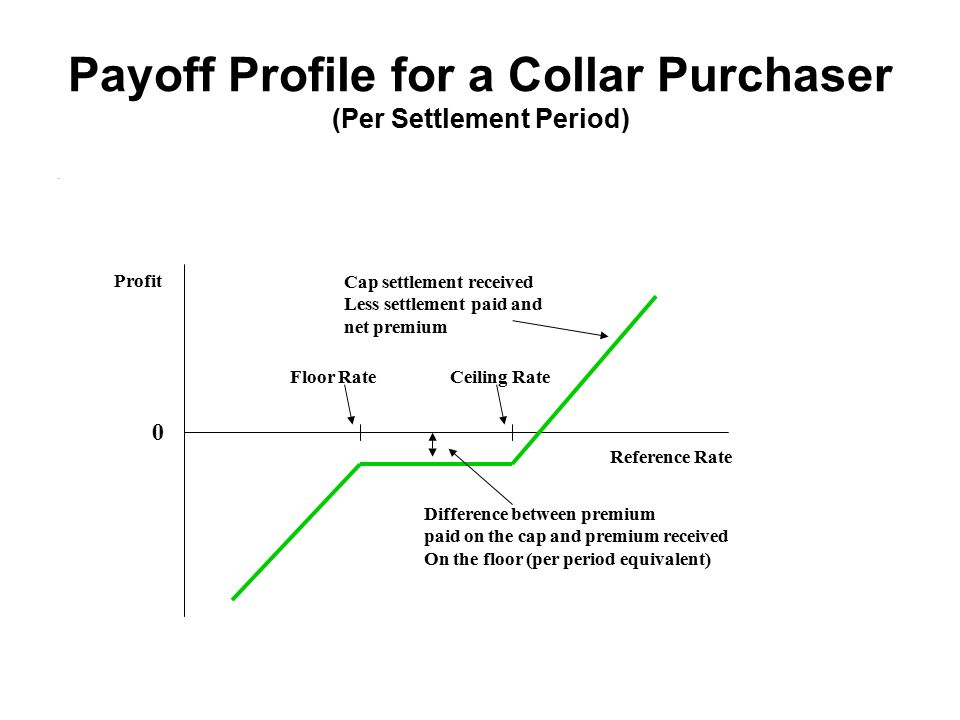

Bunker collars, Swaptions, Case 1: Zero-cost collars, Case 2: Participating collars - Freight Derivatives and Risk Management in Shipping

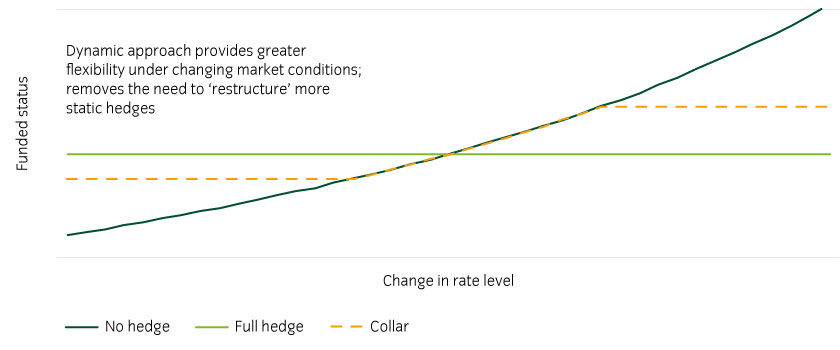

Constructing a Liability Hedging Portfolio: A Guide to Best Practices for US Pension Plans - Cambridge Associates

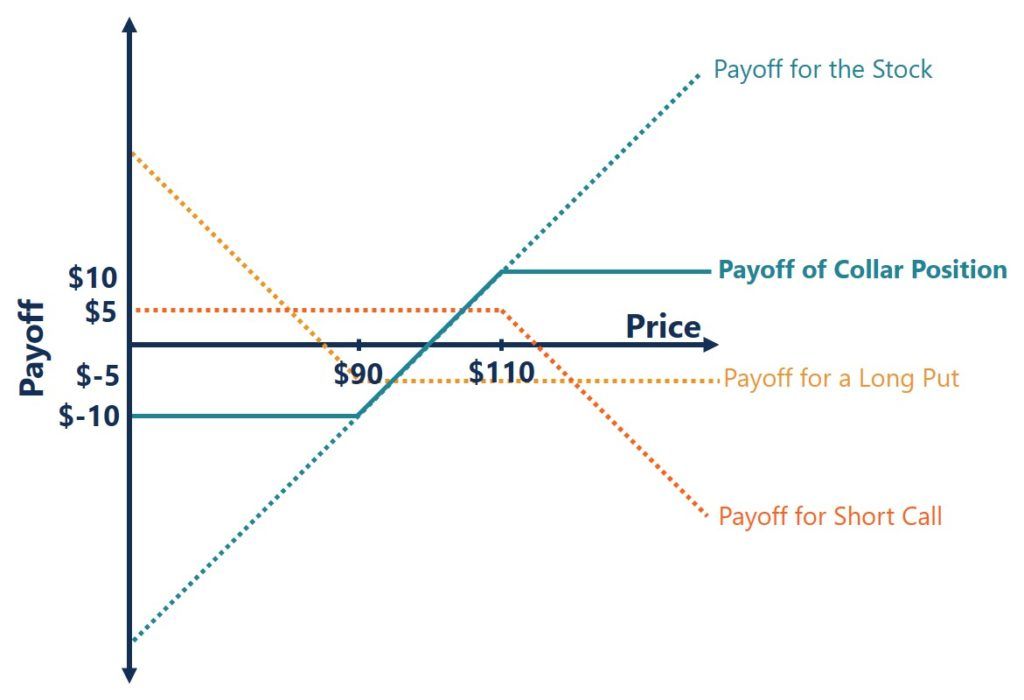

:max_bytes(150000):strip_icc()/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)

/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)